Become an SMC Business Partner – Start Your Own Business Now

ABOUT SMC

Established in 1990, we are a well-diversified financial services company in India offering services across brokerage

(across the asset classes of Equities, Commodities and Currency), investment banking, wealth management, distribution

of third party financial products, research, financing, depository services, insurance broking, clearing services and real

estate advisory services to corporate, institutional, high net worth individuals and other retail clients.

As one of the financial institutions in India in the broking and financial products distribution segment, we believe that

our ability to identify emerging trends in the Indian capital markets sector and creating business lines and service

offerings around them, has given us a competitive edge over other participants in the industry. We believe the wide

range of products and services that we offer enables us to build stronger relationships with our clients and cross sell our

products.

We service our clients through a network of 98 branches including overseas office at Dubai and more than 2,400

registered sub-brokers and authorized persons with PAN India presence in over 500+ cities. Additionally, to support our

distribution of third party financial products, we have more than 24,000 registered associates/service providers who are

engaged with us on a non-exclusive basis under our banner.

SERVICES OFFERED –

• Broking:

Trading in Equities, Derivatives, Commodities, Currency & Debt

Depository in Equity & Commodity

• Distribution:

IPOs, Mutual Funds, Bonds, Fixed Deposits

Insurance – Life & General

• Advisory:

Investment banking – IPO, FPO

Mergers & Acquisitions, Private Equity

Term Loan, Bond Issuance

Debt Restructuring, Rights, QIPs, etc.

• Wealth Management :

Portfolio Management

Multi Manager Investment Solutions, Quant Portfolio, Structured Products

Real Estate Solutions

Private Equity, Portfolio Advisory, Financial Planning

Arbitrage & Hedging

• Financing

Loan against shares,

Retail IPO financing

General Funding

Home Loan

Mortgage Loan (Loan against Property)

Unsecured loan (Personal Loan)

www.smcindiaonline.com

• Other Specialized Services:

Institutional Broking, Research, NRI & QFI Services

Clearing Services

Fixed Investment Desk

Trading & Clearing in DGCX

RECENT ACHIEVEMENTS –

Corporate brokerage House of the year (Source: MCX Metal & Energy Trade with Trust Awards,2018)

Fastest Growing Commercial NBFC of the year (Source: elets Awards,2018)

The Company of the year Financial Services (Source: ZEE BUSINESS Awards,2018)

Best Financial Services provider (Source: Assocham Excellence Awards,2018)

Best Performing Retail broker (Northern Region) (Source: NSE Equity Broking Awards,2017)

Best Online Trading Services Broker of the Year (Source: Assocham Excellence Awards,2017)

Best Robo Advisory For Financial Services of the Year (Source: elets Awards,2017)

Best Commodity Broker of the Year (Source: Assocham Excellence Awards,2017)

Best NBFC of the Year (Source: Assocham Excellence Awards,2017)

Best Broker with In- House Research in Bullion (Source: Assocham Excellence Awards,2016)

• Achieving Market Leadership(Order of Merit) (Source: skoch/ BSE Awards,2016)

• India’s Best Real Estate Broker of the Year (Source: theRF RealtyFact Awards,2016)

• Best Real Estate Broker of the Year (Source: Assocham Excellence Awards, 2015)

• Make in India Award for Excellence (Source: K. Mantra IT, 2015)

• Best Financial Services Provider (Source: Assocham Excellence Awards, 2015)

• Best Property Consultant of the Year – Residential (Source: ABP News Real Estate Awards, 2015)

• Corporate Broker of the Year – National (Source: 7th Annual & National Estate Summit & Awards, 2014)

• India’s Best Market Analyst Award in Commodity Fundamentals (Source: Zee Business – India’s Best Market

Analyst Awards, 2014)

• Best Commodity Broker of the year (Source: Assocham Excellence Awards, 2014)

• Best Equity Broking house in Derivative Segment in India (Source: BSE IPF-D&B Equity Broking Awards, 2014,

2013, 2012)

• Fastest Growing Equity Broking House -Large Firm (Source: BSE IPF-D&B Equity Broking Awards, 2013)

• Emerging SME Investment Banker of the year (Source: ASSOCHAM – SMEs Excellence Awards, 2013)

A) SMC AUTHORISED PERSON:-

THE BUSINESS MODULE OF OUR EXPANSION OPERATED BY AUTHORISED PERSON

An entity (Individual, Company or Partnership Firm) with good social and business contact with business bent of mind

can become our Authorised Person. Riding on the brand image, market awareness and the expertise of SMC, the

Authorised Persons can start their own businesses more easily and efficiently. However the minimum entry age is 21

years. We offer lucrative terms and conditions for all interested to join hand with SMC as Authorised Person.

OUR 360 DEGREE SUPPORT MODEL:-

1) Marketing and promotional support – SMC is a brand to reckon with and the queries/leads generated by the

advertising tools are passed on to the Authorised Person of that particular area.

www.smcindiaonline.com

2) Back office support – SMC provides application based back office software through which Authorised Person can

access his accounts and generate various required reports. Authorised Person can also access to their clients’

accounts to check all required transaction details.

3) Research Support – Our Authorised Person is provided to access all Technical Equity Reports, Fundamental

Equity Reports and Commodity Research Reports from our award winning research team.

4) RMS Support – SMC provides web based RMS facility to its Authorised Person to generate General and

Customized RMS Reports.

5) Technical Support – We offer different mode of connectivity which includes VSAT, MPLS and Internet

Connectivity. We have also established exclusive technical support center to resolve all technical queries.

B) ADVANTAGES IN SMC:

1. Complete financial services under single roof.

2. Centralized Customer Care Desk which provides immediate online solutions to all queries (if any) to any client

dealing and a Support team for new Authorized Persons for liaison during pre-commissioning phase.

3. Sub Broker/ Client training program by way of regular Investor Awareness Seminars by our highly qualified

professionals, specially deployed for the purpose of conducting seminars.

4. Technical & Fundamental Equity/ IPO/ MF/ Commodity/ Currency Research of our own Research wing via,

Regular Intraday SMS, on ODIN terminal, E-mails for all products-Morning Mantra, Evening Buzzer, Currency

report, Results & IPO update, etc. Our Weekly research newsletter Wise Money is unique feature in Industry.

5. Free of Cost integrated Web enabled 24*7 Back Office for Authorized Persons & Clients both.

6. Brand Awareness Support through regular advertisements in Print & Electronic media on national level.

7. SMC provides free of cost Standard Branding Material Kit inclusive of flex banner.

8. Good support in Business development by designing of promotional material through its branding/ advertising

agency free of cost.

9. Highly efficient technical platform with cost effective connectivity options.

10. Effective RMS system

11. State of Art trading facilities through our E Broking platform, Mobile Trading, And Tab Trading.

12. Advisory based high rewarding Mutual Fund and insurance platform.

13. Free of Cost Advance Charts tools and ‘Autotrender’ Software.

C) BASIC REQUIERMENTS FOR AUTHORISED PERSON:-

An entity (Individual, Company or, Partnership firm) with good track record & reputation in financial services/other

business/social circle with good client base with a view of Nominal Investment, Basic Infrastructure & Connectivity

(Minimum 2 Systems & Telephone lines with voice logger)

Note:

A) Mobile Trading /Browser Trading/ Tab Trading are Non-chargeable.

B) Free Web Based Back Office Support for clients.

www.smcindiaonline.com

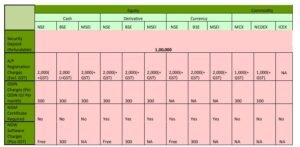

D) SECURITY DEPOSITS AND REGISTRATION FEES (One time Authorized Person Registration Fees):-

Note:

A) We can also accept 50% of security deposit as collaterals and 50% as cash.

B) Cost of broadband & internet will be bear by Authorised Person.

E: EXPOSURE LIMITS:-

Limits will be given on the basis of the margin as per exchange (VAR, SPAN, etc.) on client’s deposit/Net worth.

F: SHARING ON DELAY PAYMENT CHARGES (DPC):-

Authorised Person will get monthly credit of 10% of DPC earned from their respective clients’ account due to delay cash Pay-in.