Bangalore, August 2023: Aditya Birla Sun Life Insurance (“ABSLI”), the life insurance subsidiary of Aditya Birla Capital Limited (“ABCL”), announced the launch of an industry-first, new-age savings solution ABSLI Nishchit Laabh Plan, a non-linked non-participating individual life insurance savings plan that provides guaranteed returns with maximum flexibility.

Bangalore, August 2023: Aditya Birla Sun Life Insurance (“ABSLI”), the life insurance subsidiary of Aditya Birla Capital Limited (“ABCL”), announced the launch of an industry-first, new-age savings solution ABSLI Nishchit Laabh Plan, a non-linked non-participating individual life insurance savings plan that provides guaranteed returns with maximum flexibility.

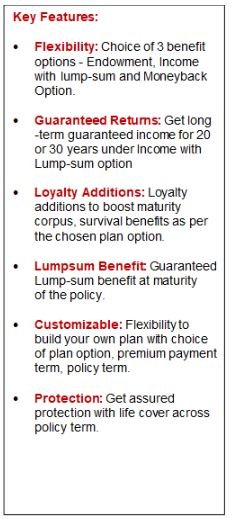

ABSLI Nishchit Laabh Plan provides an optimal blend of financial protection, guaranteed returns & utmost agility by enabling the policyholders to choose between Endowment, Income with Lump-sum, and money-back options. Policyholders will have the facility to assess and align their policy with their life goals by choosing the benefits option at the inception of the policy.

Commenting on the launch of ABSLI Nishchit Laabh Plan, Mr. Kamlesh Rao, MD & CEO, of Aditya Birla Sun Life Insurance, said, “At Aditya Birla Sun Life Insurance, it is our goal to provide innovative and affordable life insurance solutions to our customers. Our newest offering, ABSLI Nishchit Laabh Plan will empower our policyholders to customize their plan according to their needs. Along with Guaranteed Benefits, policyholders will receive increased returns in the form of loyalty addition as well.

We understand the importance of financial security, and our new product is a testament to our commitment to constantly addressing the evolving needs of our customers through persistent product innovation.”

ABSLI Nishchit Laabh Plan provides a long-term corpus creation option with a policy term spanning between 20 – 42 years. Further, policyholders will be able to boost their maturity corpus through Loyalty Additions. Along with desired agility, policyholders will get to be a benefactor of assured protection cover across policy terms, further reducing risk in their portfolio.

The plan comes with flexible Premium Payment Terms (PPT) and allows the policyholders to choose from a wide range of Policy Terms (PT) to fit individual needs. Under the Income with Lumpsum Option, the policyholder can choose between 8, 10 & 12 years as Premium Payment Term (PPT) along with an Income Term of 20 and 30 years. If the policyholder wishes to choose either Endowment or money-back option, the Premium Payment Term (PPT) will remain the same, however, the policy term will be 20 and 25 years only.