Dr. Conor O’Brien, Technology Analyst at IDTechEx

The energy storage market is booming, driven predominantly by the electrification of the transportation sector. With the increasing demand for lithium-ion batteries (LiB), significant attention has been given to the supply chain of materials for LiBs beyond lithium itself. Carbon nanotubes (CNTs) are gaining traction as a conductive additive at the cathode of LiBs, paving the way for significant expansion in the CNT market.

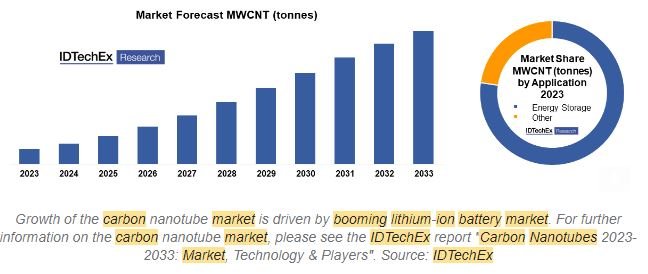

IDTechEx has extensively covered the carbon nanotube market for over a decade. The latest version of the leading report in the sector, “Carbon Nanotubes 2023-2033: Market, Technology & Players”, provides a comprehensive overview of the CNT market, including an assessment of the key application areas, major players and also includes granular 10-year market forecasts for CNT demand (tpa) and market value (US$), segmented by application areas. IDTechEx projects the market to grow in line with the booming lithium-ion battery market, given the utilization of CNTs as a conductive additive.

As mentioned, the LiB market is growing rapidly, with the market being covered extensively by IDTechEx. The annual demand for LiBs is forecast to approach 6,000 GWh by 2033, predominantly driven by electric vehicles but up from approximately 800 GWh today. While cars grab most of the headlines, electrification is also being seen across land, sea, and air, with further applications in energy storage and other electronics. With the battery itself playing a major role in the cost, performance, and safety of electric vehicles, this is a topic of innovation and therefore receives not only a lot of media attention but is the focus of industrial activity, including research and development projects.

The use of nano carbons as a conductive additive in LiBs has a number of benefits, from increasing the charge/discharge rate to easier storage of lithium ions. With respect to CNTs specifically, they are typically used alongside other conductive additives at the cathode, providing improved conductive pathways and anchorage sites. One advantage is enabling thicker anodes, leading to greater energy density. The IDTechEx report details additional benefits of including CNTs at the cathode, including structural reinforcement, enhanced conductivity, and increased battery lifetime – while also covering the downsides of the material.

This increase in demand for CNTs in the energy storage sector has translated to several large expansions in capacity by the big players in the CNT market. Cnano has a large number of notable customers while, on the other hand LG Chem is vertically integrated – both have announced significant expansions over the coming years, alongside other players such as JEIO and Kumho Petrochemical. In particular, LG Chem is set to scale capacity from 1,700 tpa to 2,900 tpa by the end of 2023 and increase again to 6,200 tpa in 2024. Cabot Corporation, a leader in the carbon black market, also entered the field a few years ago with the acquisition of SUSN. Slightly further down the value chain, most notably ToyoColor is targeting the development of CNT dispersions for energy storage applications, with supply chain agreements being put in place, alongside the establishment of JVs for the production of CNT-containing conductive pastes. Notably, the majority of activity to date has taken place in Asia, from the emergence of market leaders to the largest facilities by capacity; however, recent announcements have indicated a trend towards expansions into the North American market over the coming years.

Of course, not all CNTs are created equally, with different applications for single-walled (SWCNT) and multi-walled (MWCNT) varieties, while parameters such as the purity of the materials and aspect ratio are also of importance for energy storage applications. Several players are emerging with ambitious mid-term plans to rival the market leaders listed above in terms of production capacity. However, the quality of the material produced cost competitively at scale is yet to be proven. Similarly, other players are leaning into the sustainability aspect, employing green or waste feedstock in the production of their CNT materials, but once again, the quality of the product must be verified.

So, what is the future outlook for CNTs in energy storage? Alongside the aforementioned role in the growing LiB market, CNTs can also enable next-generation battery technology. Specifically, CNTs have opportunities in silicon anodes, lithium-sulfur batteries, and lithium metal anodes. CNTs also have existing and proposed applications beyond batteries, and these will be opened up by the maturing supply chain that will be driven by applications in the energy storage market.