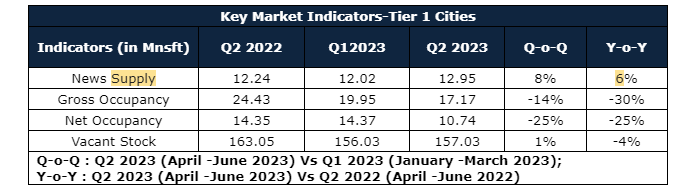

New Delhi, 14 September 2023: In a report released by PropEquity, India’s leading real estate data, research, and analytics firm, the commercial real estate market in India’s Tier-1 cities witnessed a positive increase in new supply during the second quarter of 2023. There has been a 6% increase in the new supply of commercial properties, signaling a remarkable shift in the dynamics of the sector compared to the same period last year.

Despite ongoing market fluctuations, the vacancy rates in the top Tier-1 cities of India have remained relatively stable. The latest figures indicate a marginal 4% decrease in vacancy levels compared to Q1 2023. The total vacant stock in Q2 2023 amounts to 157.03Mnsft across these cities, with the largest share attributed to MMR, accounting for 24% (25.27 Mnsft), primarily due to high vacancy percentages in the previous year.

This trend reflects the ongoing dynamics of the real estate market in India, where factors such as supply-demand imbalances, evolving business needs, and economic conditions continue to shape the commercial property landscape. While the slight reduction in vacancy rates is encouraging, it is important for industry stakeholders to remain vigilant and adaptive to effectively navigate the ever-changing real estate environment.

“The commercial real estate is witnessing a notable transformation with a 6% increase in new supply. This shift highlights the adaptability of the industry amidst ongoing market fluctuations. Remarkably, despite these fluctuations, the vacancy rates in these cities have displayed resilience, showing a marginal 4% reduction.” stated Samir Jasuja, Founder & CEO of PropEquity.

“This trend reflects the dynamic nature of India’s real estate market, shaped by factors like supply and demand dynamics, evolving business requirements, and economic conditions. As we observe this decline in vacancy rates, it remains vital for industry stakeholders to remain proactive and adaptable in navigating this ever-evolving real estate environment.” He added –

“This is a result of technology firms enacting their return-to-office strategies and accumulated demand. India’s enduring competitive edge in rental prices and workforce salaries is considered to be a driving force with long-lasting effects. This substantial growth reflects not only the resilience of the real estate sector but also the dynamic business landscape of our nation.” said Mr. Garvit Tiwari, Director & Co-Founder – InfraMantra

“This expansion is connecting businesses with prime commercial spaces that meet their evolving needs. This surge signals a bright future for India’s commercial real estate market, and we are excited to be a part of this exciting journey.” He added –

In recent times, all Tier-1 cities have experienced a notable upswing in transacted rental rates, ranging from a substantial 4% to an impressive 18% year-on-year increase. Among these urban centers, Chennai has emerged as the frontrunner, boasting an impressive 18% surge in rental values over the past year. This surge in rental appreciation underscores the growing demand for housing in these key metropolitan areas, reflecting a dynamic real estate market that continues to evolve and adapt to the changing needs of its residents.

Despite a slight decline in occupancy compared to the previous quarter, potentially due to IT sector layoffs, Bengaluru continues to lead among Tier-1 cities. Its status as the most preferred location for both Indian and global tech industries remains intact.