Mumbai, 7th November 2023: TVS Supply Chain Solutions Limited (NSE: TVSSCS, BOM: 543965), a global supply chain solutions provider and one of the largest and fastest-growing integrated supply chain solutions providers in India, today announced its consolidated unaudited financial results for the second quarter and first half of FY 2024. TVS SCS has two business segments, Integrated Supply Chain Solutions (ISCS) and Network Solutions (NS).

Mumbai, 7th November 2023: TVS Supply Chain Solutions Limited (NSE: TVSSCS, BOM: 543965), a global supply chain solutions provider and one of the largest and fastest-growing integrated supply chain solutions providers in India, today announced its consolidated unaudited financial results for the second quarter and first half of FY 2024. TVS SCS has two business segments, Integrated Supply Chain Solutions (ISCS) and Network Solutions (NS).

New deal wins:

The ISCS segment continued to deliver double-digit growth consistent with its performance in the earlier quarter. Q2 revenue grew 13.5% YoY to 1,269.5 Cr. Expansion in existing customer engagements and revenues from new business development drove broad-based revenue growth across India, the UK and Europe. New business wins in Q2 FY24 included a contract with a large Indian IT services provider, an industrial manufacturing company in India, a consumer goods business in the UK, and a shipbuilding company in India. Strong execution delivered healthy margins with Q2 Adj. EBITDA margins expanded 240 bps YoY to 10.2% and helped substantially balance the impact of the UAW strike and a scheduled plant shutdown in one of our large customers.

The half-yearly results reflect the growth momentum in the ISCS Segment. Revenue grew 16.8% YoY from 2,216.3 Cr to 2,588.4 Cr and Adj. EBITDA grew 47.4% from 182.8 Cr to 269.3 Cr translating to a margin expansion of 220 bps YoY.

The Network Solutions Segment showed a resumption of growth as revenue grew 2.4% sequentially over Q1 FY24. This was driven by growth in the IFM (Integrated Final Mile) business and sequential volume improvements in the GFS (Global Forwarding Solutions) business.

In the IFM business, the implementation of pricing, cost containment, and operational efficiency initiatives have started delivering early margin improvement. The discontinuation and sale of Circle Express by the IFM business was an important strategic intervention in this regard. This sale is expected to drive a larger focus on the core business and margin expansion in the forthcoming quarters.

The GFS (Global Forwarding Solutions) business declined revenue by almost 50% YoY in line with the global trend. However our GFS volume showed an uptick in Q2 over Q1 FY 24. We will continue to focus on business development along with customer engagements and operationally driving efficiency coupled with better utilisation to counter the revenue headwinds that we see in the immediate term.

The NS Segment Adj. EBITDA margins expanded 30 bps QoQ to 4.9% on the back of revenue growth and benefits of operational initiatives & cost management. On a half-yearly basis, the overhang of the low freight rates continued to impact the NS Segment with revenues 36.3% lower YoY from 3,083.0 Cr in H1 FY23 to 1,963.5 Cr in H1 FY24.

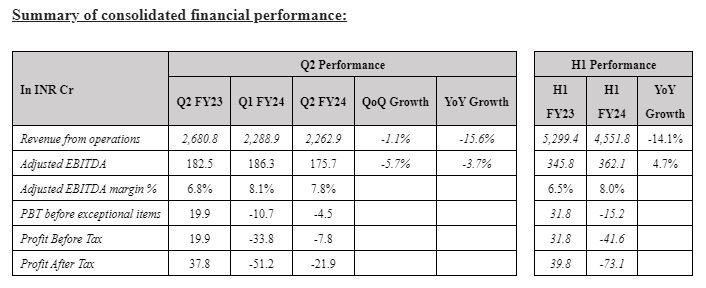

On a consolidated basis, Q2 Adj. EBITDA margins expanded 100 bps YoY as margin expansion in the ISCS segment helped balance the NS segment. Consistent margins and a decrease in interest expenses helped narrow the loss before tax and exceptional items to 4.5 Cr from a loss of 10.7 Cr in Q1 FY24.

We undertook two strategic interventions in Q2: the sale of Circle Express business and the sale of a partial stake in TVS Industrial & Logistics Parks. These two were classified as exceptional items in the quarter and their net impact was -3.2 Cr. Profit After Tax for the quarter was -21.9 Cr compared to -51.2 Cr in Q1 FY24.

Commenting on the performance, Mr. Ravi Viswanathan, Managing Director, TVS Supply Chain Solutions Ltd. said, “We continue to see robust demand for supply chain solutions across industry sectors and geographies. Our new opportunity pipeline is strong and we expect new business to continue to deliver. We are confident that our global presence, diversified revenue base, and operational excellence will drive performance.”

Commenting on the performance, Mr. Ravi Prakash Bhagavathula, Global CFO, of TVS Supply Chain Solutions Ltd. said, “We continue to focus on profitable growth and are implementing specific actions aimed at operational improvements. In Q2, we exited Circle Express, one of our businesses in the NS Segment, which will strengthen our focus on our core capabilities and also have a positive impact on profitability. The Adj. EBITDA margin expansion in the NS segment is an early outcome of these actions. We have utilized the proceeds from the IPO to reduce our borrowings as a result of which our interest costs were reduced in Q2, the full benefit of which will start flowing through starting Q3.”